Daily Payment Logs

Before practice management software, paper daily payment logs, (or DPLs), were used to track and reconcile financial transactions processed in the office on a daily basis. This function has now been integrated into most practice software. There are still situations, however, where it may be beneficial to use a customized DPL based on the practice’s needs. It is also important to remember that electronic DPLs still need to be reconciled with actual receipts. Just putting the information into the system is only the first half of the job; reconciling that input with the actual receipts is an important second step to prevent errors and theft. DPLs should ideally be “married” to the practice’s accounting functions.

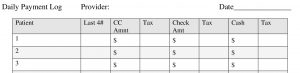

The basic DPL shows the patients and their payments by provider per day, like this:

The total per column isn’t shown, but that would be the amount that is reconciled.

Payment Log for Different Accounts

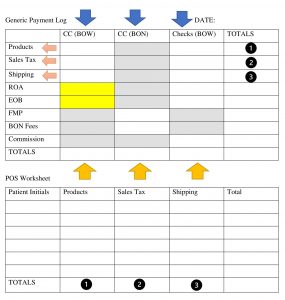

Other payment logs may still be necessary for several reasons. In this payment Log, the columns in the first chart reflect that three deposits (the blue arrows) can be made each day, based on the transaction type. Credit cards (CC) and checks are separate deposits, with credit card deposits going into two different accounts (BOW and BON). So while the actual payments may be entered into the practice software, this payment log would help to determine how those payments were deposited.

Each revenue stream is listed by row (the red arrows), with in this case are products, sales tax, shipping, received on account (ROA), EOB payments, Functional Medicine Program (FMP) payments and commissions. BON Fees are NOT a revenue stream, but a deduction that affects the total deposit into the BON account, so it is listed on a row to help reconcile that deposit. Each account is totaled (the orange arrows) to be reconciled in the accounting software.

The DPL also includes a second chart to help track and reconcile product sales, which is helpful because products sales may go in the CC BOW deposit or Check BOW. The three totals on at the bottom of the columns can be reconciled with the three row totals in the top chart to reconcile daily product sales.

Payment Logs for Different Points of Sale

Payment logs may also help to track payments when transactions occur in different areas of the office. An office may collects copays and outstanding balances at the front desk, but collect “cash” payments and products sales at a check out desk. Each of these locations may have a separate payment log to account for payments received. These two logs can then be added together to reconcile with bookkeeping.

Payment logs also present the opportunity to both track additional information and reinforce daily tasks that may be overlooked. This payment log tracks payments by type, (CC, checks and cash). It also tracks how many patients each provider saw that day with Functional Medicine Program patients separated so they can be tracked. This payment log also serves as a closing check list for the day, asking staff to not only perform tasks related to reconciling the payment log, (the tasks above the payment log), but also to do other tasks, (the tasks below the payment log), such as removing cancellations, printing tomorrow’s schedule and forwarding phones.